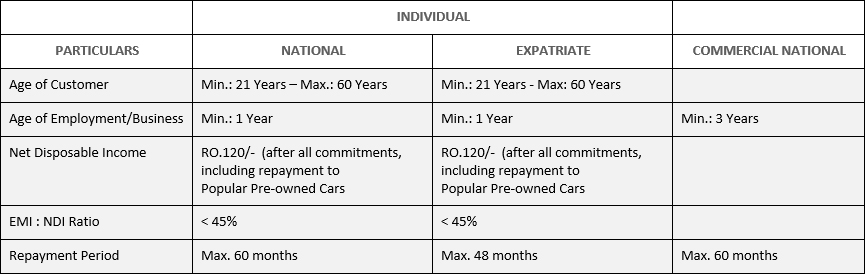

Popular Pre-owned Cars extends finance facilities to Individuals (Nationals & Expatriates) and to Corporate Establishments on purchase of pre-owned cars from us.

- Easy Monthly Installments

- Competitive Interest rate

- Flexible down payment

- Personalised Repayments

- Easy Processing

- Easy Documentations

- Ready Approvals

- Flexible Repayments

- No Hidden Charges

Loan Amount

- Used Cars - We Finance up to 85% of the value of the used car

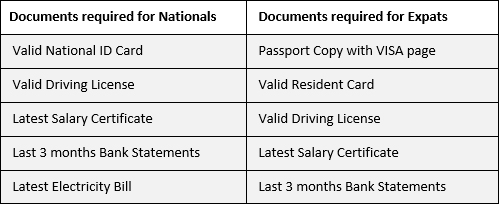

Documentation

For Companies & Establishments

- Copy of National ID Card, Sponsor/Partners, passport & Resident card for expats

- Registration Certificate.

- Chamber of Commerce Certificates.

- MOCI Sheets.

- Specimen Signature Form.

- Latest Electricity Bill & Municipal License.

- Rental Agreement.

- Last 6 months Bank Statements.

Individual

The Following documents are required to enable us to process your finance request.

- Salary certificate

- Copy of National ID / Labour Card

- Copy of Passport (Expatriates)

- Copy of Omani driving license

- Bank statement of last three months

Commercial

The Following documents are required to enable us to process your finance request.

- Copy of National ID card of Sponsor(s)/Partner(s)

- Copy of C.R. Certificate

- Copy of Computer Printout

- Copy of Specimen Signature

- Copy of Omani driving license

- Bank statement of last 3 months

Repayment

- Repayment tenure ranges from 1 year to 5 years for New cars.

- Maximum loan tenure for used car would depend on the age of the car.

- Payments through post-dated cheques (PDCs)

- Option of replacing PDC with cash is also available.

- Pre-payment option available

Application Process

You may contact the nearest showroom of our branch for the best deal available on the car of your choice.

- Email us at [email protected]

- You may also contact us +968 96330422